About

Our mission is to provide knowledge and understanding of financial information and business tools to increase prosperity for our clients, our community and our firm.

Purpose Statement

Our purpose is to provide peace of mind and knowledge to our clients, San Antonio Community and our firm to increase financial literacy and empower prosperity through the expert application of financial information and business tools.

I have a passion for helping Individuals and Businesses be successful. We succeed when our clients succeed.

Highlights

Photos and videos

Reviews

Rita S.

Tong Hui K.

Patricia A. W.

Yanko Y.

Freddie

Gabriel G.

Frequently asked questions

What is your typical process for working with a new customer?

All new clients are given a complimentary initial consultation via video or phone conference call. We discuss any questions or comments the client may have. We provide a free secure site to upload Accounting and tax documents. So you will never have visit our office. Books a Mess? No Problem! If you own a small business and haven't kept up your bookkeeping, don't worry. We can help you. We'll prepare your bookkeeping for the year, prepare a full Schedule C, as well as your personal income tax return. Then we'll help you set up an easy system that allows you to keep your books in tip-top shape next year.

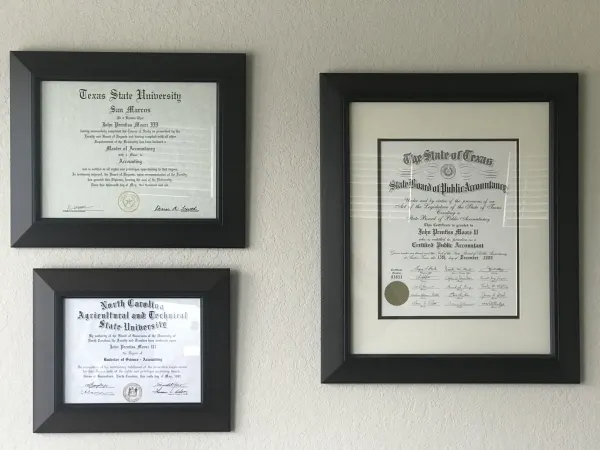

What education and/or training do you have that relates to your work?

I have a Master's degree in Accounting and I am a Certified Public Accountant. I have been serving small businesses with their tax filings and bookkeeping needs for over 16 years. Annually, I attend professional training to ensure I am up to date with all Accounting and tax law changes. I recently worked as Senior Seasonal Tax Expert Intuit, working virtually side-by-side to help TurboTax customers with tax advice, return review & preparation, product inquiries, and tax calculations.

Do you have a standard pricing system for your services? If so, please share the details here.

Typical Tax Return Preparation Pricing

Simple / Basic Federal & State Tax Returns Price

Individual Federal (No itemization, stocks, addtl schedules) $ 155

Individual Federal (itemization, interest, schedules A and B) $ 255

Additional State filing $ 75

1040 Tax Filing - Related Schedules Price

Schedule C - Self Employed income - 1099M - Sole Proprietors $ 225 - $2,500 depending on Gross Revenue

Schedule E - Rental Property - each property $ 185

Schedule K-1 (Form 1065) Income from Corporation or Partnership $ 55

Schedule D - Stock transactions, per form $ 50 + $3 per transaction

Schedule H - Nanny, Household Employee $ 85

Form 8962 - Premium Tax Credit $ 65

Form 8606 - Reporting Non-Deductible IRA $ 55

Form 4952 - Margin Interest Form $ 85

How did you get started in this business?

Doing individual tax returns and bookkeeping. Expanded from there.

What types of customers have you worked with?

Small Businesses, Individuals, Estate and Trust. My current clients include Medical and Dental Practices, Insurance company, Amazon Delivery Service Partners, Nonprofits, Freight and Trucking Companies and numerous Individual Tax Clients

Describe a recent event you are fond of.

Recently, I assisted a small business client in filing Two S-Corp returns, Two Corporate returns, Two Partnership returns, Two Estate and Trust Returns and Individual Tax Return. It took my less than a month.

What advice would you give a customer looking to hire a pro in your area of expertise?

Performing accounting transactions and preparing your own income tax return can be a task that leaves you with more questions than answers. According to a study released by the US Government's General Accounting Office, most taxpayers (77% of 71 million taxpayers) believe they benefited from using a professional Accountant and tax preparer who is certified.

What questions should customers think through before talking to pros about their needs?

If you decide to use a tax professional, you will generally find two main categories of tax service providers: the licensed tax professional—a Certified Public Accountant (CPA), or the unlicensed tax professional—a tax preparer. So which one should you choose? The answer really depends on your needs. If your tax situation is simple enough that you just need your income and deductions organized on a tax return, then you can get by using a tax preparer and generally paying a lower fee. However, if your tax needs require added value knowledge and service, then you should work with a CPA. The tax preparer category generally includes non-licensed professionals who are subject to minimal regulation, if any at all. That means that tax preparers are not required to take Continuing Education Courses (CPEs), which are a requirement for all CPA professionals. Taking these courses not only provides professional expertise, but also enhances a professional’s knowledge of new laws and tax planning strategies. Additionally, a tax preparer’s lack of licensing will limit their ability in discussing your particular tax situation upon a notice or examination by the Internal Revenue Service (IRS) or state tax authorities. A CPA has to obtain a proper degree, pass a complicated exam, obtain professional experience, and face regulation by a state board. Without completing the proper degree, tax preparers will not have the basic accounting skills required to prepare business tax returns. Additionally, simple items like loss carryovers from prior years can be omitted on your current year’s tax return due to a lack of understanding. A tax preparer can take your various income items, input them to tax return software, and press print. Most people can take items and input them to any software that they know how to use, but this is also assuming that they know the rules. For example, a tax preparer can enter partnership losses into tax software, but does he know whether the partner in question has the tax basis to deduct the losses? The software has the ability to limit those losses if you also enter the basis information, but does your tax preparer knows how to calculate your basis, which could be very complex at times? Generally, a CPA will have better tools and more insight to assist you in researching complex tax positions, as well as a larger knowledge base that they can apply in minimizing your tax liability, within the limits of the tax code. We will be happy to review your tax situation and advise you on what is the best fit for you. We generally recommend the services of a CPA if your tax situation is more complex than wages and a few interest income items. Here is another way to look at this: the point of buying insurance is to protect you if something happens, right? Using a CPA is a sort of insurance policy for your taxes and is worth the extra cost, especially if your tax situation is complex.